Issued by Labis Michalopoulos, CFA

Editorial:

An accurate forecast is what is feeding this business. A forecast that contradicts with the established trend and pays off, has an even better taste. I was arguing in favor of long EURUSD trades since the 81st issue published on 24 August. The call failed during the first week, but keeping my ground and continue supporting the long EUR trades is starting to pay off.

I am positioning in favor of the continuation of the risk-on mode, with USD falling and EUR-AUD-CAD and equities advancing, during the next week.

Major events of last week:

- USA-China: The week began with China submitting a formal complain to the WTO against the USA and ended with new round of talks have been announced from the state Chinese TV. “Substantial progress” was the selection of words to describe it.

- EU-China-USA: Mike Pence criticized Germany for not spending enough on defense, some days before the visit of Angela Merkel to Beijing.

- South Korea-Japan: The relations deteriorate further. Note that S. Korea used all the available options to save the trade relations (i.e. complaints at the WTO, US mediation, boy-cottage of Japanese products)

- Iran is set to depart further from the 2015 nuclear deal. USA will penalize companies that do business with the Iranian Space Agency.

- An Indian mission failed to soft land on the moon.

-

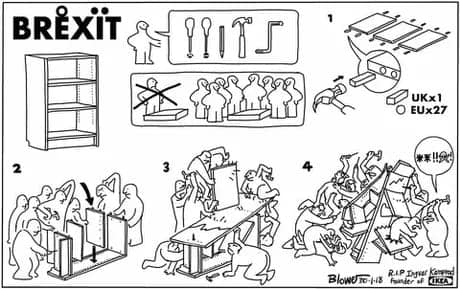

EU politics: The anti-EU, anti-immigration “Alternative for Germany” party did not manage to win the two state elections in Saxony and Branderburg. In the UK, Boris Johnson’s coalition government does not enjoy any more the Parliament’s majority. UK parliament voted a bill that blocks the possibility of a no-deal Brexit and asks for an extension of the 31st of October deadline. Yet, the parliament rejected Boris Johnson’s bill for snap elections. Meanwhile UK Chancellor announced a big spending package.

- Chief Executive of Hong Kong, has formally addressed the citizens of Hong Kong. She counter-argued the 5 key demands of protests and pledged for the ending of violence and the initiation of dialogue. She announced (i) the full withdrawal of the “Fugitive Offenders Bill” that has sparked the protests (a bill that was suspended since June 15, but was never withdrawn due to China’s disapproval) (ii) the support of the work of the Independent Police Complaints Council (iii) the government’s invitation to academics to review the public discontent that extends beyond the bill and covers social justice, housing and land supply, income distribution, social justice. Protests have non come to an end. Fitch has downgraded the Hong Kong debt.

- Argentina imposed capital controls and Greece got rid of its own capital controls imposed since 2015.

- Cryptos: Total market cap at $268bn +8% w/w. (-30% from the 2019 high, -67% from the all time high).

- Macros: US factory orders and US unit labor cost increased. US Non-farm payrolls was 130K, way smaller than the past reading, but enough to provide full opportunities for young people entering the workforce. Both the Australian and the Canadian Central Banks left their rates unchanged.

Major events of next week:

- OPEC’s monthly report is expected on Wednesday

- Monetary meeting of the ECB on Thursday. Bazooka easing is within expectations.

To continue reading this week’s detailed forecasts and macro analysis, please donate at the Paypal button at quantomental.com or at the Paypal button of Trading Robots.

The process is not automated. You need to visit one of the two sites, find the Paypal button at the right part of your screen and donate. You will be directed to donate to Trading Robots.

The highest donor of the month will have the privilege to enjoy an intense dinner with me and an original thinker. Next dinner is scheduled for the 29th of September.

Disclaimer

For the readers of the report:

Redistribution is allowed as long as the author and his contact details are referenced.

This material is for Qualified Investors and Professional Clients only and should not be relied upon by any other person.

Past performance or past accurate forecasts is not a guide to future performance and the accuracy of future forecasts and should not be the sole factor of consideration. All financial investment decisions involve an element of risk.

This report is for information purposes only and does not constitute an offer or invitation to anyone to invest or trade and has not been prepared in connection with any such offer.

Any research in this document has been independently produced by Labis Michalopoulos, CFA for his own purpose, and is intentionally written in first person. The views expressed do not constitute investment or any other advice and are subject to change. The author has an interest in the currency pairs, indexes and any other security disclosed in this report, as he is an active trader.

Reliance upon information in this material is at the sole discretion of the reader.

Opinions expressed in the report do not represent the opinion of Zulutrade, XM or any other company that is being advertised and do not constitute an offer or invitation to anyone to invest or trade.

For qualified perspective clients of the advisory service:

GIPS standards are all about full, fair, consistent and comparable presentation of actual returns of the past. No models, no back-testing, no promises. I am doing that. I am publishing in real time, via a 3rd party, my actual returns since inception where one can see the most strict, comparable, revealing metric of the industry: the monthly Sharpe ratio.

My current monthly Sharpe ratio stands at 0.27 as can be found at www.forexfactory.com/dxmix

My current annual Sharpe ratio is 0.27 multiplied by √12 = 0.27 x 3.46=0.93 Annual Sharpe Ratio

The numbers used to stand at 0.5 monthly Sharpe ratio and 1.73 annual Sharpe ratio up until the August of 2019 for 45 consecutive months. On 24 August 2018, I mistakenly ordered to open a position 10 times bigger that I am used to. My equity level is currently back on track, but my statistics are no longer as impressive as they used to be. My 54 months, since inception, monthly Sharpe Ratio (that includes the leveraged AUDUSD trade) stands at 0.27, equal to 0.93 Annual Sharpe Ratio.

I cannot claim that I will be performing with the return of my best months, but I can tell that I will hover around my average returns. Claiming with a 95% confidence, that my next month* return will be within my average monthly return ± 2 standard deviations is a well educated statement I can make anytime.

My average monthly* return ± 2 standard deviations is from -16.54% up to 20.49%

My average monthly* return ± 2 stadard deviations becomes -5.74% up to 9.47% , excluding the 4 months effect of the one time mistake trade.

* the monthly returns are the actual returns within a month. They are not presented on annualized basis.