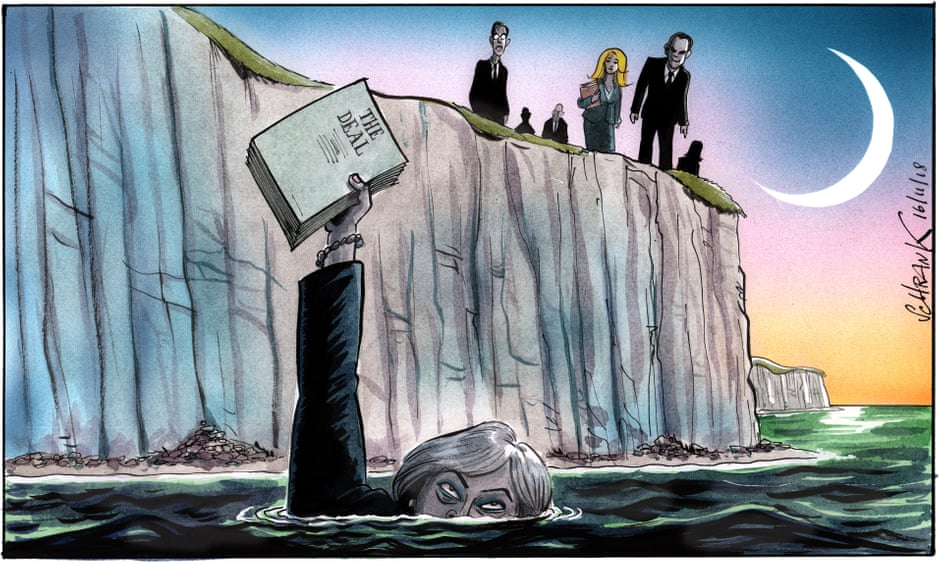

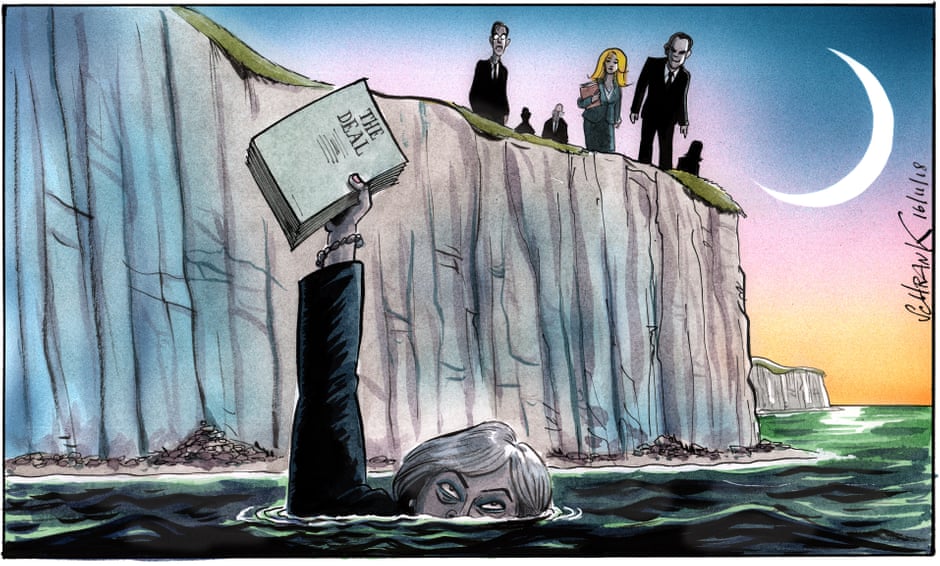

Created by Peter Schrank, published in The Guardian

Cabinet members’ resignations following UK-EU draft deal

It has been an amazing week, with 3 out of 4 forecasts hitting bull’s eye. I have called for short USD trades, long EURJPY at 127.53 (the pair bounced at 127.48), long AUDUSD at 0.7175 (the pair bounced at 0.7163) and long EURUSD at 1.1210 (the pair bounced at 1.1214, our level was never triggered and we missed the move).

The end of November will either mark EU-UK deal and US-China deal or everything with fail. The first seems hard, the second one seems easier.

Major events of last week:

-

UK: Too many events happened at the Brexit front. They are covered in the GBP page of the report

-

Europe: EPP (the biggest party in European Parliament) voted to support Manfred Weber who tolerates populists and authoritarians, instead of Alex Stubb, as a candidate for the succession of Jean Claude Juncker, the current Commission President

-

USA-China, APEC summit: Mike Pence visited Abe in Japan and then headed to the APEC summit in New Guinea. He communicated the US $60bn fund intended for infrastructure projects in the region, competitive to the One Belt One Road initiative of the Chinese. In the meantime, China sent a 143 items list to USA full of promises and Trump revealed that the next wave of tariffs will not be imposed.

- Cryptos: Total market cap fell to $182bn, -15% w/w, -77% from January’s $821bn peak, lower than the September’s $186bn low.

Major events of next week:

- The outcome of the Brexit drama and the possible extra EU summit intended to happen next Sunday, 25th of November.

JPY

I would close my long EURJPY trade.

Snapshot deteriorated:

- Core CPI (=BOJ’s compass) at 1.0% (2.0% target,expects 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP fell to 0.30% annual, -0.3% q/q, 10Y Government bonds yield at 0.10%(-2bps w/w) vs BOJ’s target of 0.00±0.20% level

- Unemployment at 2.3%

Strengths of JPY:

-

The new agreement signed with China

- Abe’s win at the Liberal Party elections provides stability.

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike in Oct’19, rules out any possible monetary policy change, before 2020.

- improving macro readings:, inflation, unemployment, capital spending, sentiment readings and all industries activity (new negative release is expected)

Weaknesses of JPY:

-

the weak macro numbers the Japanese economy is recording

-

even if a new equity sell off happens, which I consider unlikely, JPY is not currently my first save haven asset to go to.

-

real GDP readings are expected to decrease within 2019

- deteriorating macro readings: GDP reading, bank lending, housing spending, retail sales, manufacturing PMI, housing starts,Services PMI, M2, industrial production,trade balance and current account

Watch:

-

Monday’s Trade Balance and Wednesday’s all industries m/m activity are expected to be weak

-

Thursday’s Inflation reading and Friday’s Manufacturing PMI

-

Next Monetary Meeting on 20 December

CAD

I would avoid to trade CAD, unless there are concrete decisions announced at the OPEC+ meeting in Abu Dhabi, that would push oil prices higher.

Snapshot unchanged.

- Inflation at 2.2% (vs 2.5% target, BOC expects 2.0% within 1Q19), BOC rate at 1.75% (4 hikes in the cycle, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 1.9% (vs. BOC expectations of 2.0% in 2018 and long term potential of 1.8%), GDP m/m at 0.1%, 10Y Government bonds yield at 2.51% (-1bps w/w).

- Unemployment at 5.8%

Strengths of CAD:

- the volatile inflation readings were explained by the volatile airfare prices so the recent drop has not postponed BOC’s rate hike. The 1.75% rate is still characterized as stimulative

- investment indicator rebounded to a high level, following the recent USMCA deal

-

USA uses the 72~80$ per barrel Brend price range as a benchmark for it’s sanctions on Iran

- improving macro readings: unemployment, trade balance, building permits, Ivey PMI (index constructed from survey of purchase managers)

Weakness of CAD:

- oil prices are heading south as demand growth is slowing and US inventory levels are rising for the 7th week in a row. Watch the OPEC’s meeting at the start of the week and the OPEC’s montly review.

- oil demand shock driven by marine-time industry may happen on 2020 or even later.

- deteriorating macro readings: GDP, Manufacturing PMI, wholesale sales, foreign securities purchases and retail sales

Watch:

-

Monday is a holiday. No market moving announcements are expected.

-

Next Monetary Meeting on 5 December

AUD

I would go long AUDUSD at 0.7175 targeting 0.7400

At the latest RBA’s meeting it was once again noted the robust GDP growth, the importance of household consumption in an environment of rising lending standards, the low government bond yields that do not let AUD rising, and the government initiatives that decrease the cost of living and inflation.

AUD is currently moved by the will of Chinese interventions and the development of China-USA trade talks. Any news in the direction of a trade deal to be signed at the next G20 meeting on 30th of November, favors AUDUSD. The absence of such news pushes AUDUSD lower.

Snapshot unchanged:

- Inflation at 1.9% (expected at 1.75% later in 2018 and then higher in 2019), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.4% (RBA updated expectation to 3.5% within 2018 and 2019), 10y Bond yields at 2.75%(+5bps w/w) the gradual increase of yields is helping AUD

- Unemployment at 5.0% (expected to reach 4.75% by the end of 2020)

Strengths:

- RBA’s rate is unchanged with no hikes in the cycle. On the other hand, a rate hike is possible within April 2019 and Australian banks are already increasing their lending rates

- AUD is demonstrated a persuasive behavior during all latest equity sell offs.

-

I expect Australian Household consumption to increase

- improving macro readings: GDP, employment change, household consumption recovered in 3Q18, trade balance, consumer sentiment, home sales

Weaknesses:

- Australia is having a minority government

- deteriorating macro readings: M1, home loans, construction activity, current account,company operating profits, decreasing capital expenditure, building approvals, retail sales

Watch:

-

Wednesday’s Wage Price Index. A number above 0.6% favors long AUDUSD trades.

-

Thursday’s Inflation Expectations and Unemployment rate.

-

Next Monetary Meeting on 4 December

USD

I keep my ground and favor short USD positions.

The only take away of the brief press release of last week’s FED meeting, is that inflation target has been met and further gradual rate hikes will come.

Snapshot unchanged:

- Core PCE (=FED’s inflation compass) at 2.0%, CPI at 2.3%, FED ‘s rate at 2.25% and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP at 3.0%y/y, 3.5% q/q, 10y Bond yields at 3.19%(-1 bps w/w)

- Unemployment at 3.7%

Strengths of USD – Risk off points:

- The combination of increasing wholesale and business inventories and decreasing retail sales is alarming

- Equities stoped rising following the FED’s press release

Weaknesses of USD -Risk on points:

-

Stronger USD does not help neither equities nor US economy

- inflation is not worrying. Latest releases showed decreasing numbers, labor cost data decreased & Trump canceled a 2.1% wage raise for federal employees.

- risk-on news like a EU-UK negotiations concluding, consensus with China, and a modus vivendi between EU and the Italian government may simultaneously hit the headlines sending USD lower.

-

Improving macro readings : GDP, Manufacturing PMI, Non-manufacturing PMI, Services PMI, durable goods orders and housing market

Watch:

-

Monday is a holiday

-

Wednesday’s inflation readings

-

Thursday’s retail sales and business inventories

-

Next Monetary Meeting on 19 December. There is an 75% probability of a rate hike

EUR

I would go long EURUSD at 1.1210

Snapshot unchanged:

- Annual CPI at 2.2%, core CPI (=ECB’s compass) at 1.1%, ECB ‘s rate at 0.00%

- GDP at 1.7%(OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.35 (-3bps w/w), 10y German Bond yields at 0.41% (-2bps w/w), 10y Italian Bond yield at 3.41% (+12bps w/w, +61bps in 7 weeks), 10y Greek Bonds yields at 4.38% (+8bps w/w)

- Unemployment at 8.1%

Strengths of EUR/USD:

- Italian debt latest downgrade by rating agencies, has been downplayed by markets.

- inflation is peaking up

- excluding Italy, fiscal policies will not be as neutral as previously expected.

- improving macro readings: Services PMI, M3, wage growth, German factory orders, industrial production, current account and trade balance

Weaknesses of EURUSD:

-

German Economy reported negative GDP q/q growth

-

Italian budget drama may be prolonged. The most probable scenario is that Italy will be placed in the Excessive Debt Procedure by EU and any change of Italian budget will be made after the European elections in May 2019

- EU economy is loosing momentum and the automobile sector is having troubles

-

the different stages of monetary policy between EU and US, can only be simulated with another dip of EUR/USD in mid December. (the expected dip on late September has already happened, as I had noted at previous reports)

- deteriorating macro readings: GDP, Manufacturing PMI, retail sales, investor confidence and economic sentiment, German Trade balance

Watch:

-

Tuesday’s Economic Sentiment and any news from Italy, as this is the deadline given by EU so that Italians commit changes to their budget

-

Wednesday’s GDP, Thursday’s Trade Balance and Friday’s Inflation readings.

-

Next Monetary Meeting on 13 December

GBP

No forecast for GBP.

The last week included everything. Monday’s headlines that a deal has been reached in the negotiators level, Tuesday’s bad reaction of the Tories asking for a confidence vote against Teresa May, to Cabinet’s eventual support, to the resignation of three Cabiner members, the Brexit Secretary Dominic Raab, the Junior Brexit Secretary Esther McVey and the Northern Ireland minister.

Next week will either be concluded with an extra EU summit on Sunday 25 ratifying the draft agreement or will end with a confidence vote against May. The later would need 48 signatures and we are now counting 23.

Staying out of GBP trades still makes sense but pays nothing. For any of you able to build/order and use Expert Advisors (=Trading Robots) it make sense to follow north or south moves whenever the 5 minutes ATR indicator of the last 3 candles is above 0.0015

Snapshot mixed:

- Inflation at 2.4% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP at 1.5% (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.41% (-8bps w/w)

- Unemployment increased to 4.1%

Strengths:

-

during the latest press conference of BOE, it was revealed that without Brexit uncertainty, BOE would have think more of rising rates

- positive macro releases: Construction PMI, average earnings, decreased actual inflation, lending to individuals, trade balance, retail sales

Weaknesses:

- a no deal with EU is possible. In this case UK would be able to be competitive to EU regulatory wise, but would loose tax revenues from the decrease of financial activity in the City.

- the no deal scenario has already been characterized as bad outcome by Mark Corney (Governor of BOE) and has been quantified to be equal to a £80bn in public finance by Philip Hammond (Head of Treasury)

- Negative macro releases:GDP m/m, M4,Service PMI, Manufacturing production, Manufacturing PMI, construction output, consumer’s confidence, current account, industrial order expectations, home prices

Watch:

-

UK politics and negotiation process

-

Tuesday’s Services Average earnings and Wednesday’s Inflation readings

-

Thursday’s GDP Retail Sales

-

Next Monetary Meeting on 20 December

Disclaimer

Issued by Labis Michalopoulos, CFA

https://quantomental.com

To help speed reading green is used for numbers that have a risk on effect, red is used for numbers with risk off effect, blue is used for new arguments, forecasts are underlined and found at the beginning of each page.

Readers checking the returns at www.forexfactory.com/dxmix will notice a leveraged trade on AUDUSD opened on 24 August that ruined the hard earned statistics of 0.5 montly Sharpe Ratio, for over 45 months. I mistakenly ordered to open a position 10 times bigger than I am used to, and my reaction to the mistake was a series of new wrong actions.

This material is for Qualified Investors and Professional Clients only and should not be relied upon by any other persons.The degree of confidence in our forecasts gets smaller, the more knoledge we posses for each security.

Past performance or past accurate forecasts is not a guide to future performance and the accuracy of future forecasts and should not be the sole factor of consideration. All financial investments involve an element of risk. Therefore, the value of your investment and the income from it will vary and your initial investment amount cannot be guaranteed. Changes in the rates of exchange between currencies may cause the value of investments to go up and down. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

This report is for information purposes only and does not constitute an offer or invitation to anyone to invest or trade and has not been prepared in connection with any such offer.

Any research in this document has been produced by Labis Michalopoulos, CFA for his own purpose. The views expressed do not constitute investment or any other advice and are subject to change. The author has an interest in the currency pairs, indexes and any other security disclosed in this report as he is an active trader.

Reliance upon information in this material is at the sole discretion of the reader.