Report for 12 Feb-17 Feb

Following the euphoria that was expressed in all panels of this year’s World Economic Forum (23-26 January), markets have experienced two straight weeks of huge equity sell-off. Such a 2 week decrease has never happened before.

JPY:

Usually in such risk-off circumstances JPY gets stronger as it is considered to be a safe haven. Same scenario is happening now. The decreasing current account of Japan, published on Thursday (1.48T) stands above long term average and does not change the picture. In the coming week, that begins with the Monday’s Bank Holiday during which a reversal is even more unlikely, Ι do not expect market moving announcements. Something to watch is the Monday’s late night PPI release (23:50 GMT). A reading bellow 2.5% could potentially trigger a reversal and weakening of JPY, but Ι do not believe in this scenario.

CAD:

Canada is the only major economy that experiences growth coupled with the desired level of inflation. Inflation stands at 1.9% and GDP growth is acknowledged by the Central Bank to be higher than long term average. Yet, the rosy picture seems to have already been priced in USDCAD long before the last two weeks equity sell off, as the pair was at 1.2400 level and heading south and as the rates increased to 1.25% on17 January (as anticipated).

Since then, CAD is experiencing pressure from the decreasing oil prices and USDCAD pair is heading north. Last week USDCAD increased and tested the technically significant level of 1.2580 1.2610. Despite Friday’s unexpected release regarding employment (from +78K employment change in Dec to -88K in Jan) the pair did not broke higher and that is an indication of consolidation in the current levels for the coming week.

No market moving announcements expected for the week. Watch the OPEC’s 10minutes video market review, to be released on Monday (MOMR February 2018).

AUD

The last week’s monetary policy decision (rates remained unchanged at 1.50%) and the wording of the Governor’s statement has not brought any new insides. GDP is expected to grow at 3%, the alarming increase of house prices of the past seems to have been contained, unemployment is low at 5.5%, and the first signs of difficulty finding qualified workers are spotted. On the other hand, Australia ‘s terms of trade expected to decline.

The Equity sell off, found AUDUSD heading south from 0.80 all the way down to the 200 Days Moving Average. The 200MA holded, as happened with the SP500. Remains to be seen if equities will continue their slide and if the 0.7750 will hold.

Major macro-announcement of the week is scheduled for late Wednesday (Thursday 00:30 GMT) but Ι do not expect that it will move the market. Watch for Governor’s Lowe speech on Friday, in case the equity sell off continues.

USD

Ι cannot make any argument based on the macro-economic indicators of US economy. Economy is growing at a healthy rate of 2.5%, unemployment is at 4.1%, the biggest tax reform is already a reality (expected to add 0.2% growth to World’s 2018 GDP according to IMF) and the tightening cycle has began with a very gradual pace of rate hikes since Dec 15. We are counting 5 hikes of 25bps so far, resulting to a current FED rate of 1.50% which Ι expect to reach the peak of 2.75% ~3.00%, the lowest level of any tightening cycle so far.

Yet, an analysis that would focus on growth, employment change, PMI, inflation, wage growth, consumption and resulting path of FED rate hikes seems to be obsolete.

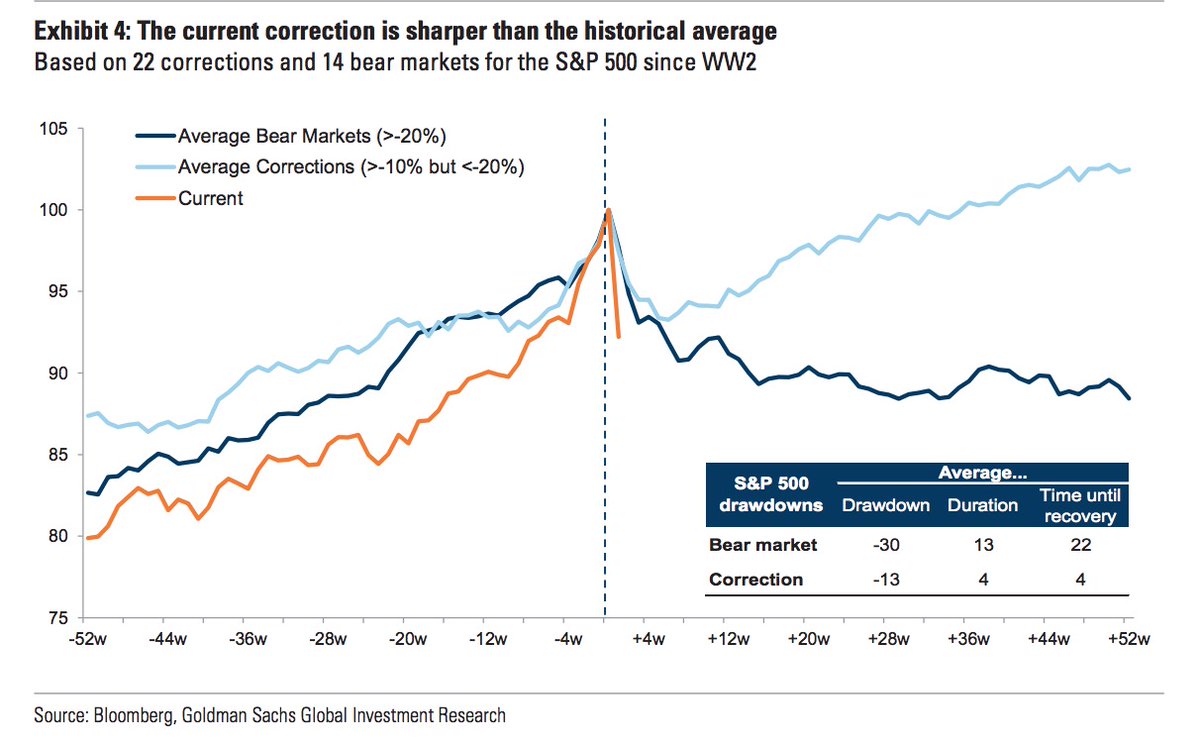

The equity sell-off of the last two weeks was steep. Commentators noted that there was a bounce at the significant 200day MA, 2.541 level of S&P500. Nevertheless, same arguments about significant resistance levels could also have been made for higher levels of S&P500. I cannot imagine how a 200day MA has managed to decrease the importance of fear in current conditions. Consequently I am biased towards long positions on USD.

EUR

European’s Economy great 2017 run took everyone by surprise. Note that at the beginning of 2017 the consensus was for 1.3%~1.8% GDP growth and the actual number proved to be at 2.4% GDP growth. EURUSD managed to come all the way up to 1.2500 but the uptrend has been stopped by the equity sell-off.

As seen by the bellow EURUSD chart, there is still enough room for a south direction especially now that we are 3 weeks away from the Italian Elections of the 4th of March.

Worth noted macro-announcements for the week ahead are the Thursday’s Trade Balance figure that needs to confirm Europe’s economic strength and the Thursday’s Spanish 10y bond auction that needs to quantify the fear factor. Last auctioned yield was for 1.53%. Note that during the past week, despite the equity storm, Greece managed to auction 7year bonds with 3.50% yield.

GBP

UK’s economy at a glance stands at 1.5% GDP growth, 4.3% unemployment and 3.00% inflation Note that UK is the only major economy that experiences higher inflation than the targeted 2%.

Having said that, last week’s monetary policy summary and minutes communication gave some worth noting insides. Both the Official bank rate and Asset Purchases remained the same at 0.50% and 435B GBP but it was signaled that a second rate hike on the 10th of May is probable.

For the next week, one should watch the CPI reading, scheduled on Tuesday at 9:30 GMT, that needs to confirm that inflation is getting lower from the last 3.00% reading.

Finally let me conclude with some thoughts on the equities sell off.

When euphoria turns to be the only recognizable flair around the world, then the bubble is about to burst. This was my main scenario since the summer of 2017. I could never had imagined that Trump could actually pass his tax reform, that DowJones30 would reach 26.800 points or that equities had more upside potential. Both happened and I would have lost money and investor’s trust if I started positioning my portfolio for such a scenario. Now, the scenario of bubble bursting may be actually happening.

Some commentators believed that is was triggered by the big correction of cryptocurrencies, others believed that it was triggered by the realization that major economies have closed their output gap and the next thing we will witness is inflation increasing out of control. Bloomberg L.P was attributing the sell-off to leveraged volatility products like SVXY and VIX.

My understanding is that the market is over-invested in passive/index-mimicking strategies and that a downturn, as the one we are experiencing now, reveals that the exit door is way to small when everyone is running for it.