Issue 2

Markets seem to have passed the panic mode of last week. It is difficult to assume what exactly will happen in a short time horizon of one week, but I strongly believe that the rosy picture of 2017 belongs to the past. I expect more downward pressure, and I regard last weeks rally or any further uptrend, as an opportunity to build short positions. I cannot imagine that last week marked the end of the storm. The week 19 Feb~23Feb begins with a Bank Holiday on Monday (President’s Day in USA and Clean Monday for the Orthodox Christians) and includes the end of China’s one week Lunar Year Holiday. Shanghai and Shenzhen Exchanges will re-open on Thursday and I am interested to find out their opening level.

JPY:

JPY is getting stronger, I maintain my last week’s view and I do not expect a reversal happening. Announcing a replacement of the current Central Bank’s Governor, as his term expires in April, could have been a reason for reversal. Yet, last week it was announced that Kuroda will serve for another 5 years.

Something to pay attention during the week is the trade balance announcement (expected later today Sunday 23:50 GMT) and the 200DayMovingAverage level 130.84 of EURJPY.

CAD:

Canada is the only major economy that experiences growth coupled with the desired level of inflation. Inflation stands at 1.9% and GDP growth is acknowledged by the Central Bank to be higher than long term average. Yet, the rosy picture seems to have already been priced in USDCAD long before February’s equity sell off, as the pair was at 1.2400 level and heading south and as the rates increased to 1.25% on17 January (as anticipated).

Since then, CAD is experiencing pressure and USDCAD pair is heading north but is failing to stay on top of the technically significant 1.2630 level. USDCAD last week’s consolidation move is expected to continue for the coming week.

Next monetary decision is scheduled for the 7th of March. During this week, no market moving announcements are expected.

Given that we will not experience another equity sell-off, I do not expect the pair crossing north the 1.2670 level (so I am closing any long positions there) and I could not find a reason for the pair crossing south the 1.2500 level (so I am being long there). I believe on the continuation of a consolidation move up until the pair finds it’s 200DayMovingAverage

AUD

At the last monetary policy decision, on the 6th Feb, rates remained unchanged at 1.50% and the wording of the Governor’s statement has not brought any new insides. GDP is expected to grow at 3%, the alarming increase of house prices of the past seems to have been contained, unemployment is low at 5.5% and expected to fall, and the first signs of difficulty finding qualified workers are spotted. On the other hand, Australia ‘s terms of trade expected to decline. Next monetary policy meeting is scheduled for the 6th of March and no rate change is expected.

February’s equity sell off, found AUDUSD heading south from 0.80 all the way down to the 200 Days Moving Average. The 200MA holded, and was retested on Wednesday.

Current levels seem to represent the fair value for the pair. Given that we will not experience a new equity sell-off, I believe that 0.7840 level will act as a support and 0.8000 level will act as a resistance.

I cannot mark any major macro-announcements for the coming week. I feel that Governor’s Lowe 16th Feb speech included everything you would need to know about the Central Bank’s thinking and the Tuesday’s scheduled release on the minutes of meeting will not add anything.

USD

US economy is growing at a healthy rate of 2.5%, unemployment is at 4.1%, the biggest tax reform is already a reality (expected to add 0.2% growth to World’s 2018 GDP according to IMF) and the tightening cycle has began with a very gradual pace of rate hikes since Dec 15. We are counting 5 hikes of 25bps so far, resulting to a current FED rate of 1.50% which Ι expect to reach the peak of 2.75% ~3.00%, the lowest level of any tightening cycle so far. (Next FOMC meeting is scheduled for the 21st of March)

Yet, an analysis that would focus on growth, employment change, PMI, inflation, wage growth, consumption and resulting path of FED rate hikes seems to be obsolete as we are only one week away from February’s big equity sell off and much repricing of risk is under way.

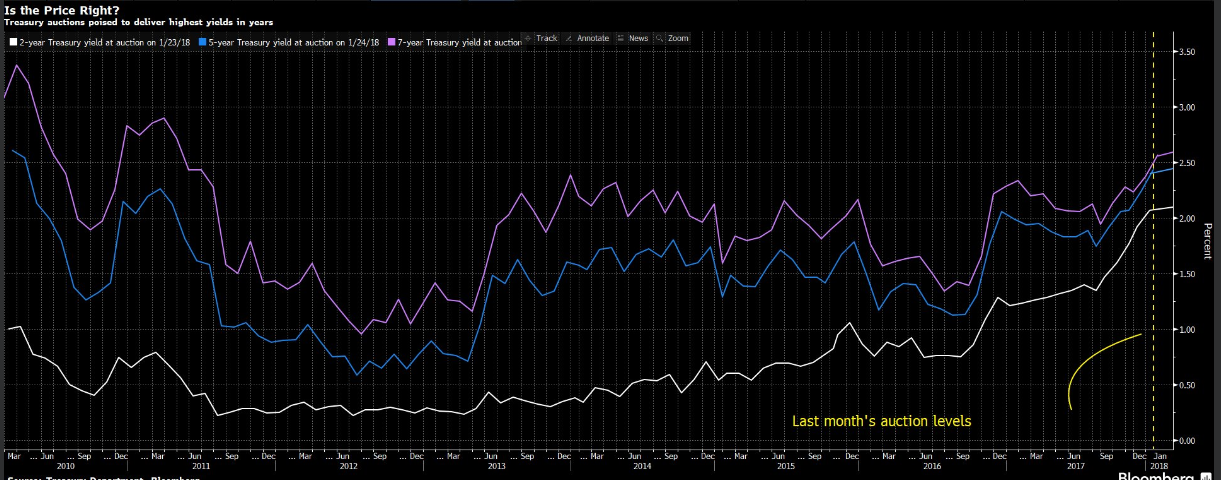

I am maintaining my long bias on USD. My next week’s focus will be on the auctions of US Goverment Bonds and how high the yields will become. USA will sell 51Billion$ 3month, 45B$ 6m , 55B$ 4w , 28B 2year , 35B$ 5y, 29B$ 7y Bonds and too much conclusions will be derived from all these auctions during Tuesday and Wendesday.

Bellow is a chart from Bloomberg that shows the increasing yields of 2y, 5y and 7y Bonds.

EUR

European’s Economy great 2017 run took everyone by surprise. Note that at the beginning of 2017 the consensus was for 1.3%~1.8% GDP growth and the actual number proved to be at 2.4% GDP growth. EURUSD managed to come all the way up to 1.2500, retreated during the February’s equity sell-off and retested the 1.2550 level last Friday.

My expectations were wrong and the pair did not moved south. In fact, when the Spanish 10y bonds yielded 1.58% (only 5bps higher from the past) my expectations that fear would dominate the markets, did not materialize.

I would still avoid taking long positions on EURUSD though, as we are only 2 weeks away from the Italian Elections of the 4th of March

Worth noted macro-announcement for the week ahead is the ZEW economic sentiment indicator scheduled for Tuesday 20:00GMT.

GBP

UK’s economy at a glance stands at 1.5% GDP growth, 4.3% unemployment and 3.00% inflation Note that UK is the only major economy that experiences higher inflation than the targeted 2%.

Having said that, the 8th of Feb monetary policy summary and minutes communication gave some worth noting insides. Both the Official bank rate and Asset Purchases remained the same at 0.50% and 435B GBP but it was signaled that a second rate hike on the 10th of May is probable.

The CPI reading released on the 13th Feb at 9:30GMT indicated that the 3.00% inflation is not declining as expected, and thus a rate hike becomes even more probable and I am becoming biased to take long positions. The current 1.4038 opening level is not that tempting but a 1.3800 becomes tempting.

Watch for the speech of Central Bank’s Governor Carney, on Monday 18:45GMT

Finally let us conclude with some thoughts

When euphoria turns to be the only recognizable flair around the world, then the bubble is about to burst. This was my main scenario since the summer of 2017. I could never had imagined that Trump could actually pass his tax reform, that DowJones30 would reach 26.800 points or that equities had more upside potential. Both happened and I would have lost money and investor’s trust if I started positioning my portfolio for such a scenario.

The first two weeks of February were marked by a big equity sell off and the bubble bursting scenario was presenting itself. Last week (12Feb~16Feb 2018) showed that fear has not became dominant.

The explanation that is being given is that the unexpectedly increased unit labour costs published on the 1st of February, triggered a sell off (for fear of out of control inflation). This increased market volatility beyond a threshold that resulted in the collapse of two short volatility products. To cover the collapse there was an even greater equity sell off. Bulls were waiting at the 200Day Moving Average to enter the market, as there was no other significant technical level for them to enter.

Do you buy it….?

Disclaimer

Issued by Labis Michalopoulos, CFA

This material is for Qualified Investors and Professional Clients only and should not be relied upon by any other persons.

Past performance or past accurate forecasts is not a guide to future performance and the accuracey of future forecasts and should not be the sole factor of consideration. All financial investments involve an element of risk. Therefore, the value of your investment and the income from it will vary and your initial investment amount cannot be guaranteed. Changes in the rates of exchange between currencies may cause the value of investments to go up and down. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

This report is for information purposes only and does not constitute an offer or invitation to anyone to invest or trade and has not been prepared in connection with any such offer.

Any research in this document has acted by Labis Michalopoulos, CFA for his own purpose. The views expressed do not constitute investment or any other advice and are subject to change. They do not reflect the views of no company or any part thereof and no assurances are made as to their accuracy.

Reliance upon information in this material is at the sole discretion of the reader.