12 minutes read report, 9 pages

How the forecasts did:

None of my forecasts of last week were triggered. I have noted that the risk-off mode of the first week of February could easily end, if the US-China trade negotiations have a positive outcome, but I was unwilling to call what would happen.

I am favoring the continuation of the risk-on mode.

Major take events of last week:

- USA-China: There was no concrete announcement from the ongoing negotiations that took place in Beijing, other than news agencies reporting that progress has been made and an expressed possibility that the 1st of March deadline could be extended for another 60 days. “Negotiations are doing well, but who knows what that means” was a Trump’s quote on Friday.

- USA: Α deal has been brokered in the US Congress that eliminates the risk of a potential new government shutdown during 2019. The deal was budgeting $1.4bn for security purposes rather than the requested $5bn. As a result, Trump moved on and declared National Security, a move that will most probably be challenged in the Courts.

- A US-led summit on the Middle East took place in Poland: The summit was supposed to help create new alliances between the USA, the EU, Israel, Saudi Arabia and the rest Sunni Arab countries against Iran, as the USA is planning to decrease its military presence and as they have withdrawn from the agreement that is monitoring Iran’s nuclear program.

- EU: Strikes in Belgium

- China-Taiwan: China has intensified its campaign to isolate Taiwan, lobbying in the region’s peak diplomatic body, the Pacific Islands’ Forum (PIF), to formally embrace the One China policy.

- Russia: Russia plans to build a grain terminal in the Crimea at a cost of $25.4 million

- Cryptos: Total market cap at $120bn, +5.0% w/w, -85% from last year’s $821bn peak.

Major events of next week:

- US-China trade negotiations continue. This time, negotiators will move to Washington. The deliverable of all trade talks will be limited to a memorandum of understanding. Forced technology transfers, IP protection, and an increase of Chinese purchases are on the agenda.

- A Court debate on whether Trump has the right to declare a state of national emergency, is likely to take place. National Emergency has been called 56 times in the past. Trump’s case is that the USA is being invaded by traffickers, gangs and drug dealers from the Mexican border. He expects to be sued, loose the first two Courts and win at the Supreme Court.

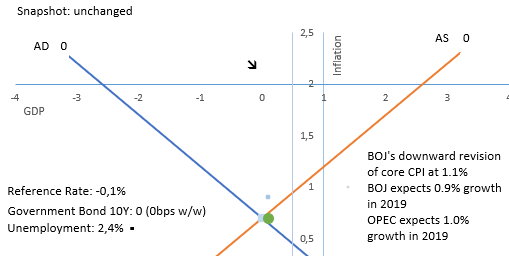

JPY

Long EURJPY at 124.70

Strengths of JPY:

- GDP q/q growth rebounded from the negative territory.

- improving macro readings: GDP (yet, it is expected to decrease in 2019), unemployment, current account, average cash earnings, household spending, bank lending, housing starts,capital spending, industries activity, industrial production, manufacturing PMI

Weaknesses of JPY:

- deteriorating macro readings:, inflation, retail sales,Services PMI, M2, trade balance, monetary base, sentiment reading

Watch / New Releases:

- Trade balance, Manufacturing PMI, core inflation reading

- Next Monetary Meeting on 15 March

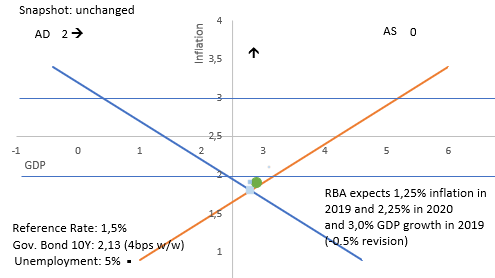

AUD

Long AUDUSD at 0.7095

Strengths:

- China’s impressive increase of new loans

- improving macro readings: GDP, trade balance, inflation, inflation expectations, unemployment, M1, service PMI, AIG manufacturing index, household consumption recovered in 3Q18, wage price index, construction index, consumer’s sentiment, business confidence

Weaknesses:

- The governor of the Central Bank (RBA) referring to the interest rates, reminded that over 2018 the next-move-is-up scenarios were more likely than the next-move-is-down scenarios. Now, he said that the probabilities appear to be more evenly balanced and markets are already pricing a rate decrease by December

- Uncertainty on housing market (prices are expected to reach a -14% drop) and household consumption due to low income growth, high levels of debt and housing becoming a buyers market, remains. Yet consumer sentiment is improving.

- Elections on November

- deteriorating macro readings: retail sales, inflation gauge, job advertisements, manufacturing PMI, home sales, home loans, current account,company operating profits, decreasing capital expenditure, building approvals, private capital expenditure, private sector credit

Watch / New Releases:

- Manufacturing PMI, Service PMI, unemployment

- Next monetary meeting on 5 March.

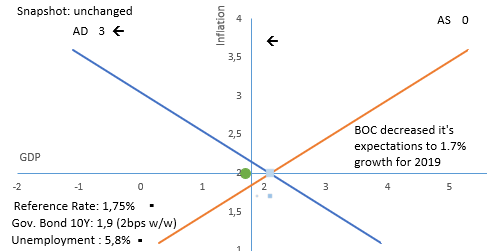

CAD

Long USDCAD at 1.3162 and long AUDCAD at 0,9408

Strengths of CAD:

- improving macro readings: inflation, current account, building permits, corporate profits

Weakness of CAD:

- Another resignation from Canada’s Cabinet. This time, it was the Minister of Veterans Affairs (former Minister of Justice). She resigned when it was revealed that she was forced by the Prime Minister to help the big contractor, SNC-Lavalin, avoid criminal prosecution while she was serving as a Minister of Justice.

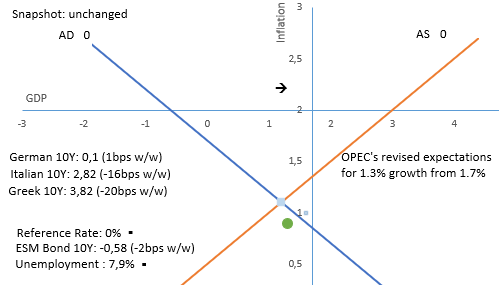

- OPEC’s February report on the oil market, included another downward revision of the global oil demand growth. (1.29Mb/day increase, was revised to 1.24Mb/day increase) so that by the end of 2019 World would consume the round number of 100MB/day.

- deteriorating macro readings: GDP, unemployment, trade balance, Manufacturing PMI, manufacturing sales, wholesale sales, retail sales, Ivey PMI, foreign securities purchases

Watch / New Releases:

- Retail sales and wholesale sales

- Next Monetary meeting on March 4.The latest macro releases do not favor the rate hike scenario I was supporting during the previous weeks.

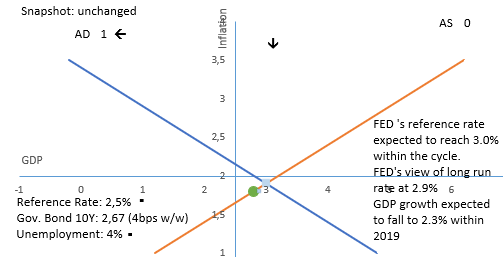

USD

Short USDindex at 0.9736

Strengths of USD – Risk off points:

- the recent equity sell off.

- deteriorating macro readings: GDP, current account, retail sales, Non-manufacturing PMI, industrial production, consumer credit, optimism,consumer confidence, consumer credit, home sales, vehicles sales

Weaknesses of USD -Risk on points

- The possibility of a new government shutdown is removed and trade talks with China are heading to a positive direction.

- FED changed it’s communication and is currently on hold as there is zero inflationary pressure. Both Inflation expectations and capacity utilization rates are falling.

- The US economy grows with no signs of inflation. New releases are expected this week.

- Improving macro readings: trade balance, Manufacturing PMI, durable goods orders, capacity utilization rate, consumer sentiment, construction spending, wholesale inventories moving lower, the decreasing business inventories is positive

Watch / New Releases:

- Monday is a holiday

- Manufacturing PMI, Service PMI, Existing Home sales and the minutes of the latest FOMC meeting.

- next Monetary Meeting on 20 March. No hike is expected.

EUR

Long EURUSD at 1.1273

Strengths of EURUSD:

- improving macro readings: M3, trade balance, unemployment, Services PMI, German GDP, German Trade balance, wage growth, industrial production, economic sentiment, private loans

Weaknesses of EURUSD:

- downward revisions of expected GDP growth from European commission. 1.3% EU growth from 1.9% expected in November, 0.2% Italian growth from 1.2%. Inflation revised to 1.4% from 1.8%

- markets are projecting at least another 2-3 years of re-investment of maturing securities and the first rate hike in 2020

- Both the German and the Italian Economy have reported negative GDP q/q growth. Yet Germany managed to avoid the technical recession as the latest published GDP q/q growth was 0.0%

- Worsening relations between France and Italy over the ‘gilets jaunes’ and immigration

- deteriorating macro readings: GDP, inflation, PPI, retail sales, manufacturing PMI, current account, investor confidence,consumer confidence, German factory orders, German industrial production, German retail sales

Watch / New Releases:

- Economic Sentiment, Manufacturing PMI, Service PMI, inflation readings

- Next Monetary Meeting on 7 March.

GBP

No forecasts for GBP

We are only 6 weeks away from the deadline of Article 50 and the most probable scenario is the extension of the deadline, new elections and/or a new referendum.

Prime Minister May lost a parliamentary vote regarding Brexit for the 10th time. The hard-line Brexiters from her conservative party abstained.

Strengths:

- improving macro releases: unemployment, retail sales, Manufacturing production, M4, average earnings and wages, decreased inflation, lending to individuals, trade balance

Weaknesses:

- GDP growth has slowed further. Some inflationary pressure was expected by BOE that would be responded with limited rate hikes, but inflation has already fallen bellow the 2.0% target.

- the ongoing uncertainty is already evident at macro readings, and could drag on until July. Investments have been hit the most. Latest GDP m/m reading was negative.

- deteriorating macro releases: GDP, Service PMI, consumer’s confidence, current account, industrial order expectations, home prices, Business Investments, Construction PMI, construction output, Manufacturing PMI, Industrial production

Watch / New Releases:

Disclaimer

Issued by Labis Michalopoulos, CFA

Redistribution is allowed as long as the author and his contact details are referenced.

The snapshot section of each page, contains the latest published figure of major macro releases. It is not a result of now-casting models that would potentially have revealed the effects of current US government shutdown. The coloring of bond yields depends on more than one equation/rule.

My net returns are published in real time at www.forexfactory.com/dxmix I was experiencing an Annual Sharpe Ratio of 1.73 for over 45 months (montly Sharpe ratio above 0.5) . On 24 August, I mistakenly ordered to open a position 10 times bigger that I am used to. My equity level is currently back on track, but my statistics are no longer impressive. My 48 months monthly Sharpe Ratio, that includes the leveraged AUDUSD trade, now stands at 0.30, equal to 1.03 Annual Sharpe Ratio.

This material is for Qualified Investors and Professional Clients only and should not be relied upon by any other persons.The degree of confidence in our forecasts gets smaller, the more knowledge we posses for each security.

Past performance or past accurate forecasts is not a guide to future performance and the accuracy of future forecasts and should not be the sole factor of consideration. All financial investments involve an element of risk. Levels and basis of taxation may change from time to time.

This report is for information purposes only and does not constitute an offer or invitation to anyone to invest or trade and has not been prepared in connection with any such offer.

Any research in this document has been produced by Labis Michalopoulos, CFA for his own purpose. The views expressed do not constitute investment or any other advice and are subject to change. The author has an interest in the currency pairs, indexes and any other security disclosed in this report as he is an active trader.

Reliance upon information in this material is at the sole discretion of the reader.